Windows 10 Pro Product Key For Activation Free Downlaod

The most recent iteration of Microsoft’s desktop and laptop operating system is called Windows 10 Pro Product Key. When Windows 10 Pro was introduced in 2015, it drew on the strengths of Windows 8 and 7 to provide a better user experience, security, and device integration. As of March 2022, there were more than 1 billion active Windows 10 devices, making Windows 10 Pro the most popular version of Windows ever.

Microsoft’s Fluent Design language prioritizes clarity and usability and is used for the operating system’s UI in Windows 10 pro product key free 64 bit. After being superseded by the Start Screen in Windows 8, Microsoft has returned the Start Menu. It combines the tried-and-true menu structure of previous releases with a flexible design that allows you to resize the individual live tiles.

Windows 10 Pro Product Key [100% Working] Download

Timeline, a visual representation of your actions over time, and support for multiple virtual desktops have also been added to the taskbar. Notifications, messages, and preferences can all be accessed with a single click on the Action Center. Snap Assist is a useful multitasking tool that lets you quickly and conveniently arrange windows in various predefined configurations.

The system’s configuration options may be accessed from inside the Settings app. Tablet mode optimizes the user interface for touch screens, making it more convenient to navigate without a mouse and keyboard. The familiarity of the desktop experience is combined with the convenience of touch and mobility in the Windows 10 pro product key generator. The familiarity of Windows for long-time users and the adaptability to new devices.

FAQs

Here are some frequently asked questions about Windows 10 Pro:

What are the system requirements for Windows 10 Pro?

Windows 10 Pro requires a 1GHz processor, 1GB RAM (for 32-bit) or 2GB RAM (for 64-bit), 16GB storage space, and an 800×600 display. For optimal performance, a multicore processor with 4GB RAM is recommended.

Does Windows 10 Pro support touchscreens?

Activate Windows 10 Pro product key Pro has native support for touch input on tablets and 2-in-1 devices. Tablet mode modifies the interface for touch optimization.

Is Windows 10 Pro good for gaming?

Yes, gaming capabilities are improved in Windows 10 Pro with features like DirectX 12 support for better graphics and Game Mode to improve game performance. It also supports the latest gaming peripherals.

What are the key security features of Windows 10 Pro?

Security enhancements include biometric authentication via Windows Hello, device encryption, malware protection with Windows Defender, firewalls, and parental controls. Enterprise data protection is also integrated.

Can I still use my older software and peripherals with Windows 10 Pro?

Windows 10 pro product key 2023 maintains good backward compatibility. Most software and peripherals with Windows 7 or 8 compatibility will work with Windows 10. Microsoft also provides upgrade tools for porting settings and data.

Key Features Windows 10 Pro Product Key

- BitLocker device encryption to protect data.

- Windows Information Protection for securing business data.

- Access to enterprise management and cloud tools like Azure Active Directory.

- Hyper-V virtualization for running virtual machines.

- Remote Desktop for remote access to other PCs.

- Windows Update for Business for managing enterprise updates.

- Storage Spaces for pooling storage across devices.

- Advanced networking tools like Group Policy Editor and Dynamic Host Configuration Protocol (DHCP).

These features make Windows 10 pro product key 64-bit free well-suited for deployments across large organizations. They provide IT administrators with the tools to secure devices, implement policies, facilitate remote work, and deploy virtualization.

Main Features

Let’s take a high-level look at some of the main features and capabilities of free Windows 10 Pro:

- Familiar yet flexible desktop interface with a Start Menu and taskbar.

- Touch optimization with tablet mode.

- Enhanced multitasking with features like Snap and Timeline.

- The settings app provides convenient access to system settings.

- Faster boot times and improved energy efficiency.

- Wider device support, including 2-in-1s with advanced hardware like a stylus and touch.

- Continuum for automatically adjusting interface based on whether a keyboard and mouse are present.

- Built-in security tools like Windows Hello, Device Encryption, and Windows Defender.

- Cortana digital assistant helps find documents, set reminders, and more.

- Microsoft Edge web browser with Cortana integration.

- Windows Store provides secure access to universal apps and games.

- Xbox app for accessing Xbox games, DVR capture, and live streaming.

- Native inking support across the OS for stylus input.

- Improved IT management and deployment tools for business.

Windows 10 pro product key crack provides an intuitive yet powerful operating system experience with many features for individual users and business deployments.

What’s New In Windows 10 Pro Product Key?

- Integrated calendar and mail apps.

- Improved Search highlights your frequent folders and files.

- Smarter notifications avoid repetitive alerts.

- Better management of optional driver updates.

- Controlled folder access adds ransomware protection.

- Storage health monitoring.

- Updated VPN configuration experience.

System Specifications

- Processor: 1 GHz or faster processor. Multi-core processors with 2 or more cores are recommended.

- RAM: 1GB (32-bit) or 2GB (64-bit) RAM required. 4GB RAM is recommended.

- Storage: 16GB available hard disk space required. Solid state drives (SSDs) are recommended for best performance.

- System Firmware: Secure Boot and Trusted Platform Module (TPM) 2.0 should be included in UEFI v2.3.1 Errata B.

- Graphics Card: DirectX 9 compatible graphics device with WDDM 1.0 driver support.

- Display: 800×600 minimum resolution. Screens up to 8K resolution supported. Touchscreens are supported for tablets and 2-in-1s.

- Other: DVD drive or USB port for installation. USB 3.0 ports are recommended. Internet access is required for updates and some functionality. Microsoft account is optionally recommended.

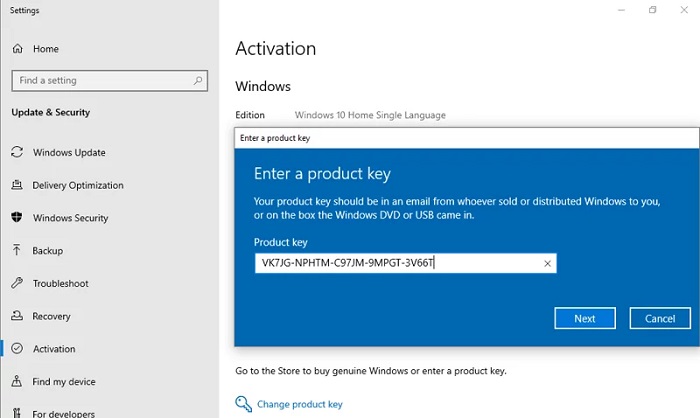

How to Activate Windows 10 Pro Product Key?

- First, open the Start menu and go to My Computer.

- Then, choose my computer and click Properties.

- You’ll find the ‘Activating Windows’ option there. Tap the button.

- Input the Product Key for Windows 10 Pro.

- Select a key from the list above, copy it, and then proceed by clicking Next and OK.

- Now, you may upgrade to the full version.

Conclusion

It’s the return of Windows with new features added for touchscreens and mobile use. Thanks to Microsoft’s frequent feature upgrades, Windows 10 Pro is always up-to-date. It maintains a happy medium between the familiarity long-time Windows users have come to expect and the cutting-edge features required by modern hardware.